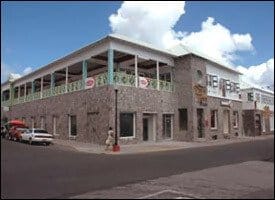

TDC Headquarters and Basseterre Plaza

Photo By Erasmus Williams

Basseterre, St. Kitts – Nevis

July 22, 2009 (CUOPM)

The St. Kitts-Nevis-Anguilla Trading and Development Company (TDC) Group of Companies is reporting a pre-tax profit of EC$13.5 million for 2008.

The company said it made EC$13,564,500 in profit compared to EC$15.3 million in 2007 and EC$12.3 million in 2006.

TDC reports improved performance in its Home and Building Depots, TDC Rentals (St. Kitts), TDC Rentals (Nevis) and the St. Kitts Automotive Division.

According to the report, the strong performance in the construction industry generated increased sales and profits for the Home and Building Depots.

“The results of our Automotive Divisions were mixed. The sales and profits for the St.Kitts operations rose quite appreciably. However, the results of the Nevis operations fell far short of management’s expectations,” the report said.

TDC reported that City Drug Store (2005) Ltd results “were negatively impacted by continuing inventory variances and weakness in sales of business equipment, related supplies and stationery. The results of the Business Equipment and Stationery Business in Nevis were again very disappointing. The business equipment side of that department has now been amalgamated with the Home and Building Depot, in an effort to reduce cost.”

The Report stated that the results of the Shipping Agencies were flat compared to last year. The industrial actions taken by port workers were resolved last year. However, due to the economic downturn in the last quarter of the year, revenues were reduced as the volume of cargo handled at ports fell.

TDC Rentals Ltd in St. Kitts and TDC Rentals (Nevis) Ltd produced marginally improved results.

“There was a little growth in the hire purchase business throughout the year and the car rentals operations were severely affected by the reduction in the long stay visitor arrivals during the later part of the year,” said the annual report officially released at the recent Annual General Meeting.

TDC reported that the St.Kitts and Nevis Finance Limited (FINCO) experienced growth in loans, deposits and profits and continued to establish itself firmly as a solid financial services provider. The company is actively pursuing ways to expand its suite of services and products to serve its growing customer base.

St.Kitts Nevis Insurance Company Ltd (SNIC) contributed significantly to the Group’s overall performance as its net profit increased over the previous year. “There were no catastrophic events during the year and the claims ““ primarily motor – were very well managed. The company applauds the passage of the legislation mandating the use of seat belts and prohibiting the use of mobile phones by drivers.

The annual report noted that Ocean Terrace Inn Ltd (OTI), like most other hotels in the federation suffered from the fallout from the international financial and economic crises which caused, among other things, the dramatic downturn in tourism travel. The company suffered a substantial loss for the year.

TDC said its airline services division had another very difficult year attributed to the effects of the global financial and economic crises. “The company had to grapple with the loss of the XL Airways service out of the United Kingdom and the contraction of the corporate jet business due to the closure of the of the Four Seasons Resort. It reported its success in securing the contract to handle the British Airways flights that replaced the XL Airways service into the Robert L. Bradshaw International Airport.

The company said the Travel Services Division of TDC Airline Services (Nevis) Ltd completed its first full year of trading as Carib World Travel. “Even though the volume of aircraft handled was not consistent throughout the year, airline ticket sales helped the company to contribute positively to the overall performance of the Group,” said the Report.

It said the results of TDC Tours Ltd, for the year, were very disappointing. “In October, immediately before the start of the tourist season, it lost a significant part of its business due to the closure of the Four Seasons Resort because of hurricane damage. In addition, very stiff competition from local tour operators and pricing pressures from the cruise lines reduced margins on tours offered by the company,” the Report added.

The company has been profitable over the years with pre-tax profit of EC$3 million in 1992; EC$4.3 million in 1993; EC$4.7 million in 1994; EC$5.4 million in 1995; EC$6.5 million in 1996; EC$7.1 million in 1997; EC$8.1 million in 1998; EC$7.4 million in 1999; EC$6.5 million in 2000, EC$5.6 million in 2001; EC$7.9 million in 2002; EC$8.6 million in 2003; EC$11.2 million in 2004; EC$11.5 million in 2005; EC$12.3 million in 2006; EC$15.3 million in 2007 and EC$13.5 million in 2008.