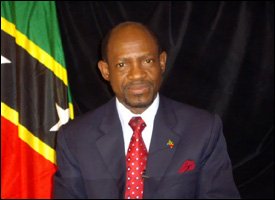

St. Kitts – Nevis’ PM – Denzil Douglas

Photo By Erasmus Williams

Basseterre, St. Kitts – Nevis

April 06, 2011 (CUOPM)

The Government of St Kitts and Nevis has unveiled a new Treasury Bill issuance programme giving investors the option of choosing from three instruments.

Prime Minister and Minister of Finance, the Hon. Dr. Denzil L. Douglas said Tuesday the new programme is in response to investor demand for greater options and longer-dated investment choices.

The Federal Government currently issues T-bills with a 91-day maturity only.

“Starting on 17 May 2011, the Government will make available new 182-day and 365-day T-bills, to be issued alongside the current 91-day instruments. Existing and new T-bill investors will be able to choose any combination of these three instruments through the established procedure. The letters that will be sent to existing T-bill holders by the Accountant General’s Department this week will confirm the improved investment menu,” said Prime Minister Douglas, following his weekly programme “Ask the Prime Minister.”

He said that existing Treasury Bill holders wishing to roll-over into any of the new securities must ensure their responses reach the Accountant General’s Department by 20 April 2011.

“The Federal Government continues to experience a very high demand for Government Treasury Bills from both local and regional investors, as confirmed by roll-over rates that are close to 100%. The Ministry of Finance has also had requests from investors for an option to lengthen the maturity of their investments thereby avoiding the inconvenience of having to go through the roll-over process every three months,” Dr. Douglas stated.

He added that his Government is pleased to be able to respond to this request from investors, and confirm that investors who do elect longer maturities will be offered moderately increased yields.

“The Government expects that the new options that will be offered to investors will also enable the average life of the public debt portfolio to be lengthened over time,” Prime Minister Douglas said.

He disclosed that another initiative that is being planned is the start of the gradual integration of the local Treasury Bill market with the Regional Government Securities Market (RGSM) ““ a move that should benefit both the Government and its investors by boosting liquidity. Further announcements will be made in this regard in due course.