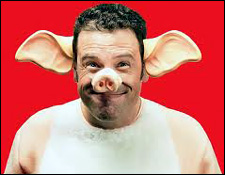

Pig Ears Will Not Be Charged In VAT Porgram

Basseterre, St. Kitts – Nevis

October 27, 2010 (CUOPM)

Ahead of the introduction of Value Added Tax (VAT) on November 1st, the St. Kitts-Nevis Labour Party Cabinet has approved the complete removal of import duty on several food and non-food items.

Twenty items have been reduced to zero percent and seven others reduced by five and 20 percent.

These will come into effect with the impending implementation of the Value-Added Tax which will see the abolition of the 22.5 percent consumption tax and the implementation of a VAT at 17 percent. However, since September Government has reduced the Consumption Tax from 22.5 percent to 17 percent.

On Monday, the Cabinet, presided over by Prime Minister Hon. Dr. Denzil L. Douglas approved the complete removal of import duty on 20 of the 27 items in the Basket of Goods introduced in 2008 with reduction on seven others.

The import duty has been completely removed from Tuna (canned); Sardine (canned); Skipjack and Bonito (canned); Sardinella, Brislings/Sprats (canned); Salmon (canned); Herrings (canned); Mackerel (canned); Chicken; Cheese; Canned Sausages; Corn Beef; Salt Fish/Herrings (Fresh); Mackerel (fresh); Salmon (Fresh); Ham (smoked, chilled, frozen); Baby Beverages (Juices); Pig Tails, Ears and Snout; Exercise books; Insecticides and rodenticides.

The import duty on Pasta, Margarine/Shortening/Lard and Vegetable Oil has been reduced from 25 percent to 10 percent and Tomato Ketchup from 20 percent to 5 percent.

The import duty on Eggs has been reduced from 40 percent to 20 percent and mosquito coils from 25 percent to 5 percent.